4 things we learned (or didn't) from the first big auction of 2021

The price of a Nautilus 5711; no one cares about modern, complicated watches; and Journe and Cartier are still, well Journe and Cartier.

If nothing else, we learned that someone will pay €12k for a 9-foot Rolex yard sign at Antiquorum’s first auction of 2021. The auction house held the first large watch auction of the year last weekend, 304 lots of watches, yard signs, and other such miscellanea.

Perhaps still sleepy with a holiday hangover, there’s not been much discussion of the results, so let’s look at a few takeaways from Antiquorum’s January 24 Important Timepieces sale.

Rescapement is a weekly newsletter about watches, mostly vintage. Subscribe now to get it delivered to your inbox every Sunday. 👉

1. €75k for a Nautilus 5711 (plus tax)

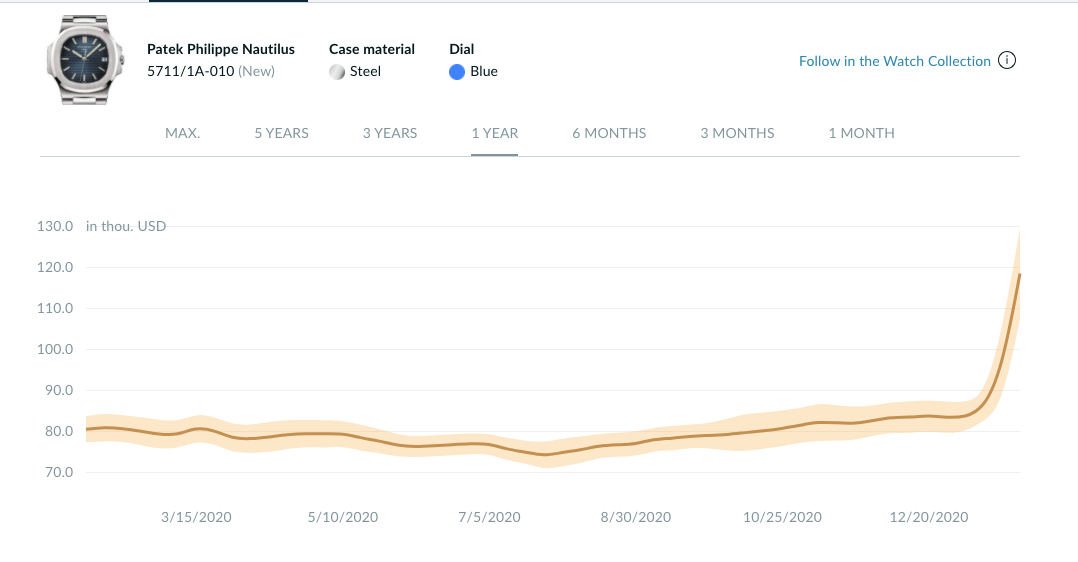

Last week, Patek announced that it was discontinuing the Nautilus ref. 5711, sending prices of the hot reference soaring higher than any asset not named $GME. If Chrono24 is to be believed, prices shot up from somewhere around $80k to $120k in a matter of days — of course, who knows what those are really selling for, but it never hurts to ask! At its auction just a few days after the discontinuation, Antiquorum offered a ref. 5711 with box and papers, selling it for €75k all-in (~$91k, plus any added tax). So, some hard, public evidence the market has popped, though perhaps not as much as an ambitious Chrono24 dealer might have hoped.

Fwiw, Antiquorum billed this as a special “LED dial” because it’s got 16 wider horizontal lines instead of the usual 18. The LED dial was produced around 2009 (as the papers of this watch indicate too). This is mainly marketing/dealer spin, and the LED dial doesn’t necessarily command a premium as compared to the typical 5711 dial (though, in this world of irrational exuberance, it’s not hard to imagine a future in which someone says “oh sh*t you’ve got the 16 liner!?” and forks over 2.5 GameStop shares to buy it on the spot, those 2.5 shares by then being worth roughly the price of Greenland). Looking at the photos, this thing has definitely been worn, but hey, the original purchaser probably thought it was a cool $30k watch when they bought it, not realizing they’d actually purchased the horological equivalent of a Tesla stock/rocketship to the moon.

2. No one really cares about modern, complicated watches?

The cover lot of Antiquorum’s auction was a Vacheron Tour de L’Ile Piece Unique in pink gold. Antiquorum first sold this uber-complicated timepiece back in 2005 for the princely sum of CHF 1.9m (upon the occasion of the 250th anniversary of VC). At the time, it was billed as the world’s most complicated wristwatch (16 complications over 2 display faces), and the sale made it the most expensive too. Since then, it’s been passed by on both measures (by Patek Philippe’s Grandmaster Chime for Only Watch).

This time around, the Tour de L’Ile passed, even at a reserve price of a mere €1.2m.[1] That’s a “down round”, as they say in Silicon Valley, and a big one at that. But, it’s kind of like MySpace in 2005 v. 2021 — what was once a hot company, the best social media there was, is no longer. Now we’ve got TikTok, Clubhouse, whatever else. Valuations are still sky-high, to be sure (as in watches), but no one wants the most complicated wristwatch from 2005 — give me the next big thing. Just because something sold for big money 15 years ago doesn’t mean it should now. Tastes move on and the market moves with it. If anything, it’s a testament to how far haute horology has come. In 2005, Greubel Forsey was barely spinning tourbillons, F.P. Journe was a pup, and Olivia Rodrigo didn’t have her driver’s license.

Or wait, do they?

“No one really cares about modern, complicated watches,” he said? Tell that to this humble-looking Blancpain minute repeater, which sold for €39k, double its high estimate. It’s a really cool watch, emblematic of the type of traditional watchmaking Blancpain brought back at the end of the 20th century (and was even keener on advertising that it brought back). The result isn’t totally out of line with recent sales of similar minute repeaters, but it’s still a solid signal.

Listen, people are flooding into neo-vintage everything — Rolex, Cartier, etc. — so it makes sense this Blancpain Minute Repeater from the 2000s would attract some ferocious bidding. I think it’s delightful someone would think to drop $40k on a precious metal, 34mm minute repeater, when the cliche move would probably be to get a gilt, steel Rolex. Clearly, this was acquired by a thoughtful collector, not one who’s too caught up with what they think they should be buying.

3. White Star, shooting star

At the beginning of the year, I wrote about White Star (a brand I’d never heard of, tbh), featuring two models from the brand that Antiquorum sold for a nice sum back in November 2020 — highlighted by a crispy, NOS White Star Diagrafic that sold for €11k. The Diagfrafic is a unique-looking watch with a date complication that, as was later pointed out to me, looks like a coronavirus.[2]

I pointed out that another White Star Diagrafic was up for sale this month, but suggested it probably shouldn’t go for a similarly large result. While that Nov. 2020 example was truly NOS, this one was anything but — relumed hands, and it seemed like the vibrant blue disc for the rotating coronavirus/sun was missing too. In fact, the underbidder on that lot even dropped into the comments of that article, saying that, he too, had no interest in White Star, but couldn’t resist an interesting, NOS watch (also hinting that he had no such interest in this particular lot). Well, apparently someone else did because it sold for €6.7k. “Two’s a pattern, three’s a market,” as the saying goes, so we’ve nearly established a solid Diagrafic market in the past three months.

As I mentioned re the Blanpain Minute Repeater, I think it’s great collectors are spotting interesting, unique watches and going after them, eschewing bigger names or trendier picks. That said, I’m not sure the condition of this particular White Star warranted such a hefty sum.

4. Journe is still Journe. Cartier is still Cartier. Vintage Rolex is still vintage Rolex.

And now, for the more of the same portion of today’s program. We saw big numbers for all the usual suspects, namely F.P. Journe, vintage Rolex, and Cartier. A CPCP Tank à Vis sold for €9.1k, a couple of super-old Santos-Dumont models sold for nearly €20k (platinum and yellow gold)[3], and so on. As for Rolex and Journe: a tasty-looking GMT-Master ref. 6542 signed by Venezuelan retailer Serpico Y Laino sold for €143k, and two Journes sold for well north of six figures. I wrote at the outset of the year that the trends of 2020 weren’t going anywhere for the foreseeable future, and these results are proof of that.

To be clear, these are great watches. I’m not even here to argue it’s a bubble. As Christian Zeron pointed out in our conversation, the F.P. Journe hype is actually based on some reasonable basis of scarcity, unlike a lot of other markets. Likewise, many of the Cartier CPCP models are numbered limited editions — not to mention they’re absolutely beautiful. But, there are a lot of great, scarce watches out there. Why focus on a few?

Sure, the Cartier and Journe trends do feel like something of a reaction against the oversaturation of Rolex and other steel sports, but why does every trend have to be taken to the extreme now? Oh, yeah — that’s why.

[1] 2/1 Update: I had previously relied on “reporting” and conversations with another publication to say that this Vacheron had actually hammered at €1.2m. It did not. The lot passed. I regret this error.

[2] Thanks, Adam.

[3] The Santos-Dumont really warrants a discussion all its own. This week, a couple big online dealers (Hodinkee Shop and Sean Song) sold yellow gold examples from the 1970s-80s for like $10k, which is almost double what these things were trading for just last summer.

Rescapement is a weekly newsletter about watches, mostly vintage. Subscribe now to get it delivered to your inbox every Sunday. Follow us on IG too.

Don't forget that on all these prices you still have to add VAT, meaning that the 5711 would go for about €90k if you import it to the EU.